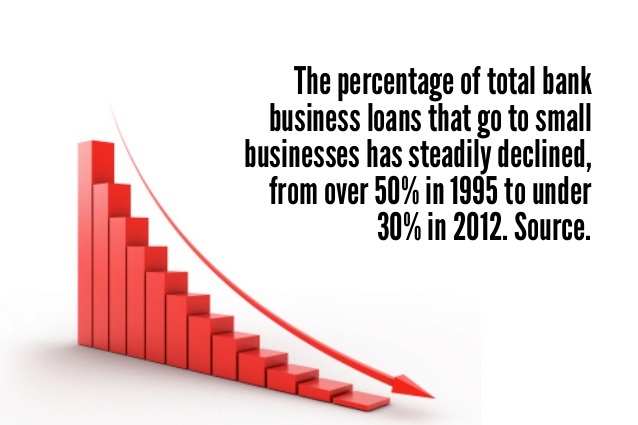

business loan declined

Surprising Reason Many Business Loan Applicants Get Denied

Did your bank Decline Your Business Loan ? Here’s Why.

Key Findings:

45% of small business owners who are denied financing get turned down more than once and 23% don’t know why their applications were denied.

Small business owners who understand their business credit scores are 41% more likely to be approved when they apply for a business loan.

Those who understand their business credit profile are also 31% more likely to consider expanding their business.

Yet, 45% of small business owners don’t know they have a business credit score and 82% don’t know how to interpret their score.

In our Spring 2015 small business survey, we learned that despite having more business financing options available, like online lenders, it’s still difficult for small business owners to access capital. In fact, the increasing number of financing options available (currently over forty different types) may actually be complicating matters for small business owners. The survey shows that of those who were denied financing, 45% had been turned down more than once, and 23% don’t know why their applications were denied.

Encouragingly, the survey did reveal a key trait among those business owners who had success applying for loans. Small business owners who understand their business credit scores were 41% more likely to get approved for a loan.

Yet, almost half of business owners don’t know they have a business credit score and 82% don’t know how to interpret it. This knowledge gap is hurting small business owners and the United States economy. Over one quarter of respondents said they’ve avoided hiring and expansion because they’re frustrated with trying to access funds. And 21% of respondents said they considered closing their doors over the past year.

Via: Creditera

Article Credit: Creditera Small Business American Dream Gap Report

Recent Comments